Major health insurance companies are nearing too big to fail status

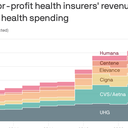

Health insurance companies have swelled in both size and scope over the last decade, with the revenues of six for-profit parent companies making up nearly 30% of total U.S. health spending last year — compared with less than 10% in 2011.

Why it matters: The size of health insurance companies — which are now often part of larger companies that do far more than provide coverage — raises big questions about competition, costs, quality of care and the risks of a system featuring such sprawling players.

- One big argument for such large, diverse companies is that by owning different components of the system, they can deliver care more efficiently with lower costs and higher quality.

- "I think the evidence is pretty weak that those outcomes have come to fruition," said Cheryl Damberg, principal senior economist at the RAND Corporation.

The big picture: The nature of health insurance(-plus) companies has changed drastically over the last decade.

- Three of them processed nearly 80% of prescription claims last year, one of them is owned by the nation's largest pharmacy chain and one has become the largest U.S. employer of doctors.

- Some of them have also recently acquired primary care providers, home health companies and urgent care services.

- "Defining what is an insurance company … in some ways has become very hard," said Craig Garthwaite, a professor at Northwestern's Kellogg School of Management.

It's an open question if insurers' transformation will help accelerate what virtually everyone in health care agrees the system must do: shift from paying per service to paying for healthier patients.

- "We don't know necessarily whether it's working yet," Garthwaite said. "I think at this point, most of the large players … they've bought all of the groceries and they haven't cooked the meal. They own what they need to right now and they're not sure what to do with it."

- "It seems hard to both lament the scope of these companies but then hope we can fundamentally change the provision of health care services," he added. "If we want to get to a place where firms are making money by people being healthier, that should be a reformulation of the sector."

Zoom in: The recent Change Healthcare hack — which disrupted claims payments and operations across the country — has prompted a new round of criticism of mergers and consolidation within the health care sector.

- Change was acquired by UnitedHealth Group in 2022. But UnitedHealth — as well as some experts — has framed the size of the parent company as a good thing.

- "Fortunately, we were able to bring to bear the substantial resources of UnitedHealth Group to drive the recovery and begin to mitigate the impact — resources which a standalone Change Healthcare would not have access to on its own," CEO Andrew Witty said on an earnings call this week.

Between the lines: It's not just that health insurers have merged with companies that do other things: They've also expanded into government-regulated markets through the Affordable Care Act exchanges, Medicare Advantage and Medicaid managed care.

- These markets — MA in particular — have been lucrative for insurers, and fierce debates are underway over whether the federal government is overpaying them.

- "Medicare has transformed into a program that's at least half of enrollees in private plans, and Medicaid, it's far more than that," said Brian Blase, founder of Paragon Health and a former Trump administration official.

- "The government doesn't let insurers lose money. They basically guarantee their profits in the annual cycle that happens, and I think insurers have done very well with the migration to bigger government health programs," he added.

Health insurance markets themselves are very local, and plans' sizes vary significantly from place to place and market to market.

- "Focusing on revenues alone provides little insight into a health plan's footprint or operations, especially when revenues also reflect the year-over-year increases in the cost of medical care," an AHIP spokesperson wrote in an email.

- Health plans are also highly regulated by states and the federal government, the spokesperson added.

The bottom line: The term "too big to fail" usually evokes the idea of government bailouts. But in health care, it may have a different meaning: They may be big enough to always win.

- "Too big to fail — I'm not convinced of that," Damberg said. "But I do think there are a fair amount of pressures being put on the players who are trying to compete, and these very large entities that have huge market share are essentially closing them out of the market.

- "So it's like you're going to be eaten one way or another," she added. "Either you join them and you're eaten that way, or you go out of business."