BlackRock's Larry Fink takes on retirement crisis in annual investor letter

BlackRock CEO Larry Fink calls for the government and private sector to coordinate to ensure Americans have enough money to retire, in his annual letter to investors out Tuesday morning.

Why it matters: It comes as little surprise to learn that the world's biggest manager of retirement funds thinks we need more retirement funds for him and others to manage. But that doesn't mean he's wrong.

The big picture: America is getting healthier — which means our retirees are living longer, and need more money to live on.

- Building "a secure, well-earned retirement is a much harder proposition than it was 30 years ago," writes Fink — "and it'll be a much harder proposition 30 years from now."

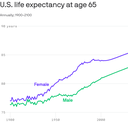

By the numbers: In 1952, most of the Americans born 65 years previously were already dead, and therefore not in need of any retirement income, according to the Social Security Administration.

- A 65-year-old man in 1952 could expect to live another 13 years, on average; a woman, 15 years.

- Today, 65-year-old men see 17 years ahead of them, while women see 20.

- When today's 30-year-olds retire in 2059, those numbers will have gone up by another two years.

Between the lines: The longer we see ourselves living, the more nervous we become about outlasting our money.

- "While retirement is mainly a saving challenge, the data is clear: It's a spending one too," writes Fink, pointing to evidence that retirees who are objectively well set for retirement are still deeply worried about it.

- Fink has a plan for that: A new product called LifePath Paycheck, which he calls "a revolution in retirement." It gives retired participants in BlackRock's target-date funds the option to convert 30% of their fund into an annuity at any point, and with a degree of pricing transparency that's very rare in the annuity industry.

What's next: Fink wants government action to ensure that whether or not Americans have access to an employer-sponsored retirement plan, they can build up a decent nest egg for when they're no longer working.

- He points to Australia's superannuation system as a good model, and says Australians "likely have more retirement savings per capita than any other country."

- He also suggests that the U.S. retirement age should rise in line with life expectancy, as it does in the Netherlands.

"As a society, we focus a tremendous amount of energy on helping people live longer lives. But not even a fraction of that effort is spent helping people afford those extra years," writes Fink, who wants to kick off a global debate.

- "Humanity has changed over the past 120 years. So must our conception of retirement. ... As a nation, we should do everything we can to make retirement investing more automatic for workers."

The bottom line: "The shift from defined benefit to defined contribution has been, for most people, a shift from financial certainty to financial uncertainty," writes Fink.

- Absent collective action that includes the government, that shift to uncertainty and worry is only going to get worse.