Exclusive: CEOs' confidence in economy surges

America's top executives are strikingly more confident about the economy, with expectations of stronger sales and capital investments — plans that indicate the economy might keep booming in the months ahead.

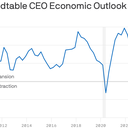

Why it matters: For the first time in two years, the Business Roundtable's quarterly gauge of CEO sentiment — first seen by Axios — is above its historical average, signaling that business leaders' economic uneasiness may finally be fading.

By the numbers: The lobbying group's index jumped by 11 points in the first quarter to 85 — topping the long-running average by 2 points.

- That double-digit surge reflects a larger share of CEOs planning to increase capital spending — investments in equipment, factories and the like — and expectations of stronger company sales relative to the previous quarter.

- The sub-index for capital spending over the next six months surged by 16 points; the sales sub-index surged by 13 points.

- Plans for hiring edged up more modestly, by 5 points. That sub-index remains depressed relative to two years ago, a sign that the rip-roaring hiring rates have been replaced with more modest employment plans.

What they're saying: "This quarter's survey results underscore the resiliency of the U.S. economy and suggest accelerating economic activity over the next six months," Cisco CEO Chuck Robbins, who chairs the Business Roundtable, said in a statement.

- "To further strengthen the economy, the U.S. needs to double down on policies that spur domestic investment and bolster American competitiveness," Robbins said, pointing to a bipartisan tax bill that's yet to be taken up by the Senate.

The lobbying group noted concerns about regulations imposing on the nation's free enterprise — which three-quarters of surveyed leaders said they agreed with.

- "A large majority of our CEOs are worried that excessive regulation and overreaching antitrust actions are eroding the foundation of free enterprise and the benefits it provides," BRT CEO Joshua Bolten said.

- CEOs are especially watching a rule expected from the Securities and Exchange Commission today requiring disclosure of climate risks, which leaders say could be unworkable for many companies.

What to watch: The BRT conducted its survey of members after key economic indicators revealed hotter-than-expected activity to begin the year, including strong job gains and quicker price increases that suggested the Fed has room to delay its telegraphed plans of lowering interest rates.

The intrigue: In a speech this week, Atlanta Fed CEO Raphael Bostic flagged rising optimism among business leaders — including some he said were "ready to deploy assets and ramp up hiring when the time is right."

- "I asked one gathering of business leaders if they were ready to pounce at the first hint of an interest rate cut," Bostic said. "The response was an overwhelming 'yes.'"

- Bostic worried that activity on a large enough scale could "unleash a burst of new demand that could reverse the progress toward rebalancing supply and demand" and reignite inflation.

- "That would create upward pressure on prices," Bostic said. "This threat of what I'll call pent-up exuberance is a new upside risk that I think bears scrutiny in coming months."

The bottom line: BRT-surveyed CEOs don't necessarily envision blowout economic growth in the year ahead. Instead, they see an economy that keeps chugging along at a healthy pace.

- They expect GDP growth of 2.1% this year — up slightly from their last estimate of 1.9%.

This story has been updated with additional context from the survey.