Merger highlights the problem with big credit card companies

If the Department of Justice decides to challenge the acquisition of Discover by Capital One on antitrust grounds, new research from the Consumer Financial Protection Bureau will surely play a prominent role in the complaint.

Why it matters: Even though some 4,000 banks offer credit cards, the top 10 issuers, including both Discover and Capital One, account for more than 80% of loans.

- That concentration seems to have given the biggest lenders the ability to jack up the interest rates they charge on outstanding credit card balances.

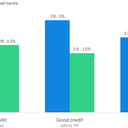

The big picture: Consumers with poor credit who have a credit card from a small bank are paying a lower interest rate on their purchases (20.6%, on average) than consumers with excellent credit who carry a card from Discover, Capital One, or one of the other big banks. They're paying 23%, on average.

- Credit card interest rates have risen sharply over the past two years, spiking from 14.6% in February 2022 to 21.5% in November 2023.

By the numbers: An American who runs an average balance of $5,000 will end up paying between $400 and $500 a year in excess interest payments if they go with one of the big banks.

- On top of that, a holder of a credit card issued by a big bank is three times more likely to be paying an annual fee than someone with a card from a small bank.

What's happening: The biggest banks have massive marketing operations and credit-card reward programs, which make it hard for smaller banks to compete even when their interest rates are much more attractive.

The bottom line: Capital One would become the largest credit card issuer in America if this deal goes through, with a 19% market share. (JPMorgan currently leads the ranking, with a 16% share.)

- For consumers, however, it's far from clear that bigger means better.