Delinquencies rise on loans tied to office buildings

Here's a quick update on the world's most well-telegraphed credit market problem — office loans.

The big picture: The WFH wars are over — hybrid work won. And the departure of roughly a quarter of white-collar workers from offices will continue rattling through the $20 trillion private commercial real estate market for the foreseeable future.

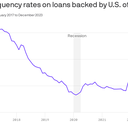

State of play: Delinquencies on commercial mortgages backed by U.S. office properties hit 5.8% in December, the highest since late 2017, according to S&P Global.

- "Given the lasting adoption of work-from-home behavior, high interest rates, and diminished credit availability, office property values across the U.S. have declined," wrote Goldman Sachs analysts in a recent note.

Drip-by-drip, we're getting confirmation of this simple reality.

- For example: The mortgage on a 26-floor midtown Manhattan office tower owned by private equity giant Blackstone is being marketed to potential buyers at a 50% discount to its face value, Bloomberg reported.

- And in earnings reports over the last week, large banks have disclosed losses linked to the sector: Bank of America charged off $100 million tied to eight office buildings, while Wells Fargo notched $377 million in charge-offs on commercial real estate loans, according to the Wall Street Journal.

Threat level: TBD.

- For those in the business of building, owning or lending to office buildings, the downturn is a concern. But it may only matter more broadly — to the economy and the markets — if it starts to seriously unsettle the banking system.

- That's where the uptick in delinquencies could become a problem.

Flashback: Commercial real estate busts have been at the heart of major financial upsets in the past, such as the S&L crisis of the 1980s and early 1990s.

Zoom in: In its most recent quarterly report on the state of the banking system — which captured conditions in Q3 2023 — the FDIC spotlighted a 36% jump in the volume of non-current commercial real estate loans. (Non-current loans are either 90 days past due or not expected to be repaid.)

- The rise has been driven primarily by deterioration in office loans, the agency said.

The bottom line: While the uptick in commercial real estate loans going bad isn't great, it's not even close to the levels of distress during and after the financial crisis of 2008.

Yes, but: We're nowhere near the end of the story.

- "It's a long movie," Wells Fargo CFO Michael Santomassimo told analysts asking about the outlook on commercial real estate after the bank reported earnings last week.

- "We're past the opening credits, but we're still in the beginning of the movie. And so, it's going to take some time for this to play out."

Go deeper: Office real estate is getting kind of ugly