What it looks like when woke capitalism takes a nap

The European lead in terms of ESG investing has widened substantially over the past two years, according to a new analysis by ShareAction that echoes similar findings from Morningstar.

Why it matters: The U.S. is home to the largest fund managers in the world — none more so than BlackRock, a company that turns out to have largely stopped voting for ESG resolutions over the past two years.

How it works: Shareholders of public companies can put forth resolutions calling on companies to, say, reveal more about the carbon footprint of their supply chain, or audit the amount of plastic waste they generate. Those resolutions are then put to a general shareholder vote, where they normally lose. Organizations like ShareAction then track which resolutions were voted for by BlackRock and other fund managers.

Context: After being attacked for being the face of "woke capitalism," BlackRock CEO Larry Fink has said he's not going to even use the term "ESG" any more. (It stands for environmental, social, and governance.) Now it seems he's unwilling even to vote for ESG resolutions.

Between the lines: Fink has said clearly that "climate risk is investment risk" and, as a member of GFANZ, is committed to accelerating the transition to a net-zero global economy.

- The catch: Most of BlackRock's assets are passively invested, meaning that the company can't divest from companies that are failing to adequately address the climate emergency or other important issues.

- Its only real recourse in such situations is to vote its shares in favor of ESG resolutions.

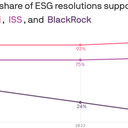

- That's something European managers such as Amundi do nearly all the time, and that ISS, the leading proxy voting advisor, recommends doing roughly 75% of the time.

By the numbers: BlackRock voted in favor of ESG resolutions 40% of the time in 2021, per ShareAction — but just 8% of the time in 2023.

The intrigue: Although the decline at BlackRock is particularly dramatic, a similar trend can be seen at substantially all of the major U.S. fund managers — including Pioneer, which is owned by Amundi, the largest investor in Europe.

- Looking at what Morningstar considers "key ESG resolutions," Pioneer, which operates under a separate local voting policy, voted for 99% of them in 2021, but just 35% in 2023.

For the record: "In 2023, because so many proposals were over-reaching, lacking economic merit, or simply redundant, they were unlikely to help promote long-term shareholder value," said BlackRock in a statement.

- "The majority of these proposals failed to recognize that companies are already meeting their asks," writes Joud Abdel Majeid, BlackRock's head of investment stewardship.

My thought bubble: If that were the case, one would expect a similar decline from ISS. But, in fact, ISS support actually increased over the two years in question.

The bottom line: While BlackRock is adamant that anti-ESG campaigning within the Republican Party isn't affecting its votes, its behavior is at least consistent with a more conciliatory stance toward such critics.