US, euro zone show how rate hikes don't necessarily drive up joblessness

The central story of the U.S. economy over the last 18 months has been that inflation has come down as unemployment has stayed low. But it's not just a U.S. story.

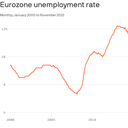

Driving the news: The unemployment rate in the eurozone fell to 6.4% in November, matching an all-time low, the Eurostat statistics agency said. That coincided with inflation of only 2.4% for the 12 months ended that month.

- The rate has come down particularly sharply in southern Europe, including Spain (11.9%, down a full percentage point over the last year) and Greece (9.4%, down from 11.9% a year earlier).

Why it matters: Price pressures have diminished on both sides of the Atlantic without workers bearing the brunt, contrary to traditional economic models.

- That largely reflects unique causes of the inflation outbreak of 2021 to 2022, but it's also a reason to question some of the doctrine on which modern economic policy rests.

State of play: In the standard narrative of how inflation works — one that undergirds monetary policy — rising prices reflect a too-tight labor market, where wages and prices spiral upward.

- When the central bank tightens monetary policy, it causes the job market to weaken, stopping that cycle and thus bringing down inflationary pressure. Higher unemployment becomes an undesirable side effect.

- The Federal Reserve and European Central Bank both raised interest rates aggressively in 2022 and 2023; inflation came down amid a continued low jobless rate in both central banks' territories.

- It reflects that much of the 2021 inflation surge was driven not by an excessively tight labor market, but supply disruptions caused by the pandemic and Ukraine war.

Of note: There is evidence of slowing in Europe — but for now, it hasn't hammered the euro currency bloc's workers very much.

- "While labor markets remain tight, there are some signs that restrictive monetary policy is impacting the economy," wrote J.P. Morgan economist Raphael Brun-Aguerre in a note, mentioning a slowdown in growth in private employment and soft purchasing managers' indexes.

- "But, this lower pace still points to a resilient labour market overall," Brun-Aguerre wrote.

Yes, but: There are exceptions to the low-unemployment conditions that apply in the U.S. and eurozone. The jobless rate has moved up significantly over the last year in the United Kingdom and Canada, for example.

The bottom line: The experience of the last year in both the U.S. and Europe could trigger acknowledgement that higher unemployment isn't always the medicine needed to relieve price pressures.