What to know about extraordinary measures as debt ceiling hit

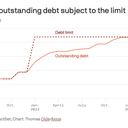

The U.S. has reached its $31.4 trillion debt ceiling, the Treasury Department announced on Thursday, with no obvious deal in sight.

Why it matters: The U.S. government runs on a deficit, so the Treasury Department will start "extraordinary measures" to avoid defaulting on government bonds.

Driving the news: Treasury Secretary Janet Yellen in a letter to Congress said that Treasury was instituting a "debt issuance suspension period" beginning Thursday and running through June 5.

- In addition, Treasury will not be able to fulfill certain investments, including to the Civil Service Retirement and Disability Fund.

- "As I stated in my January 13 letter, the period of time that extraordinary measures may last is subject to considerable uncertainty, including the challenges of forecasting the payments and receipts of the U.S. government months into the future," Yellen stated.

- "I respectfully urge Congress to act promptly to protect the full faith and credit of the United States," she added.

The big picture: These measures could be exhausted by early summer, Yellen warned last week.

- Congress last raised the debt ceiling in December of 2021, when Democrats held unified control of Congress.

What they're saying: Senate Minority Leader Mitch McConnell (R-Ky.) said Thursday that he is "not concerned with a financial crisis."

- "In the end, I think the important thing to remember is that America must never default on its debt. It never has and it never will," McConnell said.

- Senate Majority Leader Chuck Schumer (D-N.Y.), meanwhile, said: "Political brinkmanship with the debt limit would be a massive hit to local economies, American families and would be nothing less than an economic crisis at the hands of the Republicans."

How the debt ceiling is different than a government shutdown

Government shutdowns come when Congress can't get appropriations bills passed before the existing ones expire.

- The most recent shutdown was in 2018-19, and featured a general stoppage of government services, including furloughs for federal workers.

The debt ceiling requires Congress to raise the threshold to pay for already-appropriated spending.

- Raising the debt limit was generally not a big fight until the 1980s, but there have been repeated standoffs in the years, according to the Congressional Research Service.

- A debt limit impasse in 2011 led to the first downgrade in history on the U.S. federal credit rating.

How the Treasury Department's extraordinary measures work

The Treasury Department can prioritize payments, including suspending payments to long-term programs for government employees. It can repay the programs after the limit is raised.

- In her letter to Congress last week, Yellen identified the Civil Service Retirement and Disability Fund, Postal Service Retiree Health Benefits Fund and Government Securities Investment Fund as potential avenues for these extraordinary measures.

The status of debt ceiling negotiations

Democrats control the White House and Senate, but they'll need to strike some sort of deal with House Republicans.

- Status in the House: Some GOP members say they're firmly against any increase to the debt limit. House Speaker Kevin McCarthy said Tuesday he wants to “set a budget, set a path to get us to a balanced budget and let’s start paying this debt off.”

- What the White House is saying: “As President Biden has made clear, Congress must deal with the debt limit and must do so without conditions," White House Press Secretary Karine Jean-Pierre said Tuesday.