The copper crunch that's jeopardizing climate goals

The race to deeply slash global carbon emissions will be hobbled without a surge in copper supply, but the ramp-up necessary faces big hurdles, a new report finds.

Why it matters: Copper is a crucial input for clean energy technologies including electric cars, batteries, renewable power, and the transmission and grid infrastructure needed alongside it.

Driving the news: "Unless massive new supply comes online in a timely way, the goal of Net-Zero Emissions by 2050 will be short-circuited and remain out of reach," S&P Global concludes.

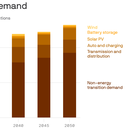

The big picture: The report estimates increases needed for clean energy growth and continued demand for traditional uses, such as buildings.

- Copper demand is slated to grow from about 25 million metric tons today to twice that amount by 2035, and substitution opportunities are very limited.

- A gap between demand and supply starts to open in the middle of this decade and grows to roughly 10 million tons by 2035 under current mining and recycling trends.

- "This would mean a 20% shortfall from the supply level required for the Net-Zero Emissions by 2050 target," S&P finds. A smaller gap still emerges under a "high ambition" scenario that models rosier assumptions about recycling and mining advances.

What they're saying: S&P vice chairman Dan Yergin, who led the project, chatted with me about copper's role in what he calls the transition from "Big Oil to big shovels" needed to confront climate change.

- "Although ... people write a lot about lithium, a lot about cobalt, copper is really essential because it's the metal of electrification and essential to the energy transition. And I think people have underestimated that," he said.

- "This study is a wake-up call," said Yergin. He notes that while a number of governments and international organizations have expressed alarm, the study provides a granular look at the problem.

- "It's one thing to express alarm, and another thing to say, well, how much do you need to do? And so we're not saying you're not going to get to the 2050 goals, but it's more challenging than people think and you have to focus on it now."

What's next: The report steers clear of specific policy recommendations, but one finding is that resource development and processing need to be easier.

- "Regulatory and fiscal regimes need to be stable and predictable to encourage investment and facilitate construction of new mines, processing facilities, and recycling plants," it notes.

- Given the typical decade-plus timeline for new mines, S&P finds that increasing utilization, capacity and lifespan of existing sites will be key in meeting nearer-term demand growth.

Of note: Mining companies supported the research, but S&P says the report is independent and told Reuters they did not see it prior to release.