The Fed aimed for an inclusive recovery. That's being put to the test

The Federal Reserve's commitment to an inclusive recovery is getting tested as it begins raising rates to combat inflation.

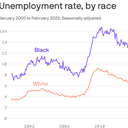

Why it matters: Higher interest rates typically slow the economy, leading to higher unemployment rates. And while the overall jobless rate is now low by historical standards, the Black unemployment rate is double that of whites and the Hispanic rate exceeds whites by more than a point.

Catch up quick: In August 2020, the Fed announced that its mandate to achieve maximum employment should be "broad-based and inclusive" — meaning it would let the economy run hotter to pull more people into the job market.

- It also aimed to pay attention to employment stats for different segments of the population instead of just the overall numbers.

The big picture: While rising prices can hurt Black workers, who are disproportionately represented in lower-paying jobs, measures to fight inflation are harsh medicine.

- “Inflation can have disproportionate adverse effects by race, but anti-inflation measures can have a disproportionate adverse effect by race. I'm not sure which one is necessarily worse," said William A. Darity, an economist at Duke, at a Brookings Institution event last week, where debate developed around the issue of race and the Fed.

- Flashback: When then-Federal Reserve chair Paul Volcker started hiking interest rates to break the record inflation decades ago, it drove the jobless rate up to around 10% — and for Black workers, to more than 22%.

Between the lines: Plenty of economists concur that the Fed should consider the effects of its policies on different groups of Americans — taking into account race, gender, age and disability. But there's less agreement on what exactly Fed officials can and should do.

- One of the Fed's mandates is to help maintain a robust labor market — Black workers are a part of that, Michelle Holder, the president of Equitable Growth, told Axios. Any argument that the Fed shouldn't take race into account is "baffling," she said.

- A recent paper that Axios' Neil Irwin wrote about shows that even in a tight labor market, a cut in the Fed's target interest rate was followed by Black employment growth of about .91 percentage points.

No one in this camp is saying the Fed shouldn't raise rates now, given where inflation is — but they argue the Fed should keep an eye on the effects that the rate hikes have on different groups.

- The Fed should also use care when characterizing the economy as having reached full unemployment, when some groups are still lagging, said Rose Khattar, an economist at the Center for American Progress. "You can definitely check the language." (Powell recently called the labor market "overheated," she noted.)

The other side: Skeptics of the inclusive mandate say the Fed's main tool — controlling interest rates — is a blunt instrument that's not well-equipped for addressing inequality.

- "There is relatively little the Fed can do," said Paul Wachtel, professor emeritus at NYU Stern School of Business. A lot of these issues should be addressed by Congress, he added.

- Loose monetary policy has only a small effect on earnings for Black households — $134 more over five years — but at the same time widens the racial wealth gap by inflating asset values, according to a paper Wachtel co-authored and presented last week at Brookings (inspiring the debate).

What we're watching: The jobs numbers, of course. The next report is out Friday.