The future of political advertising is connected TV

Political advertising has quickly begun to migrate over to connected TV (CTV), or digital and streaming television, according to new data.

Why it matters: "If the current trends of explosive growth in CTV viewership continue, we could see a tipping point where CTV makes up nearly half of political digital ad spend as soon as 2022," says Grace Briscoe, vice president of candidates and causes at Centro, a digital ad placement firm that works with hundreds of campaigns across the country.

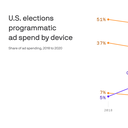

Details: New data from Centro finds that political ad spend on CTV by political campaigns outpaced overall CTV growth across the industry by more than three times. The data, which shows programmatic buying (automatic digital ad placement), points to how much campaigns are beginning to rely on CTV to reach voters.

- This data was pulled from ads that ran across the campaigns of over 400 election-related advertisers from Centro’s platform between Jan. 1, 2020 and Jan. 5, 2021, totaling more than $100 million in ad spending. The campaigns span federal, state and local elections.

- Briscoe says the increased spend in CTV "seems to be a reallocation primarily from traditional TV budgets, rather than from other digital channels," which means there will likely come a time that political ads — like all TV ads — are bought and sold digitally.

This is a huge departure from the decades-long practice of campaigns buying TV ads that are targeted to local demographic market areas without much precision other than age and gender.

- As more political ads are bought on connected TVs, more messages will be targeted much more narrowly to people based on their interests, purchasing behavior, etc. — just as they are online.

- Another big shift will be the way these ads are purchased. Unlike traditional TV ads, which are typically purchased ahead of time for a set price, Centro says more than 60% of CTV ads are purchased via programmatic real-time bidding on the ad inventory, which complicates transparency measures.

- "Providing information on advertiser spend isn’t a simple matter when transactions have millions of data points per minute that are also constantly changing," Briscoe says.

The big picture: Connected TV ads offer political advertisers the same type of messaging platform that they typically use to run GOTV (get out the vote) ads on traditional television. But unlike traditional TV ads, they are highly efficient and are hardly regulated.

- As traditional TV consumption wanes due to cord-cutting, political advertisers are shifting more of their budgets towards CTV ads, in part because they can no longer reach as many voters on traditional television.

Centro finds that Hulu last cycle captured close to a quarter of all CTV spend across its hundreds of political campaign clients.

- Briscoe says that while Hulu has been the top vendor for direct sales for political campaigns in both 2018 and 2020, much of the big growth Centro saw last cycle came from new digital TV players entering the market.

- Those included smart TV companies like Roku, and private marketplaces that sell CTV ads against content from companies like Sling, Nexstar, Viacom and others.

What to watch: As more political advertising shifts to CTV, where regulation is minimal and few transparency measures are in place, expect lawmakers to start demanding the same types of political ad disclosures they've pressured companies like Google and Facebook to implement online.