Inflation surpasses coronavirus as investors' biggest worry

Inflation is the number one risk for the market, according to a monthly survey of global asset managers commissioned by Bank of America, displacing COVID-19 for the first time since February 2020.

Details: Both inflation (37% of respondents) and the risk of a market taper tantrum (35%) beat out the pandemic as the top risk for investors.

- COVID-19 and the vaccine rollout dropped from being seen as the biggest risk by nearly 30% of respondents in February to less than 15% in March.

One level deeper: A net 93% of investors in the survey expect inflation to rise in the next 12 months, up 7 percentage points from last month and the highest reading in the history of the survey, which dates back to at least 1995.

- 53% of fund managers expect above-trend inflation along with above-trend growth over the next year, the first time that has happened since March 2011 and the third time in the history of the survey.

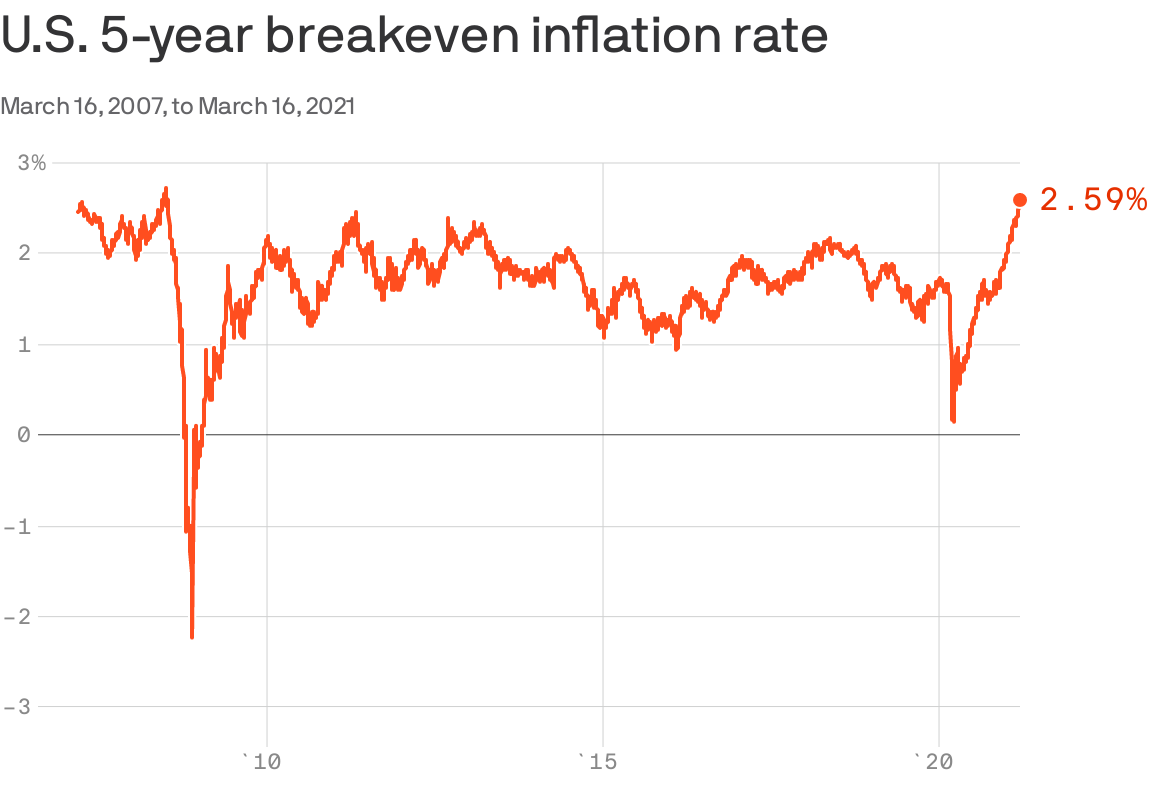

By the numbers: That matches up with sky-rocketing market gauges of inflation expectations that have jumped to yearslong highs in recent days.

- The 5-year breakeven inflation rate jumped to 2.59% on Tuesday, the highest since July 2008.

- The 10-year breakeven rate hit 2.30%, the highest since January 2014.

Of note: The survey also found fund managers were incredibly bullish, with 91% of respondents expecting a stronger economy, the highest result on record.