Jobs report is latest indicator economy doesn't have maximum employment or stable prices

January's nonfarm payrolls report made clear that the U.S. is not experiencing, nor is moving toward, maximum employment. The paltry 49,000 jobs added is only the tip of the iceberg of bad news the report contained.

By the numbers: The Labor Department also reported that the U.S. shed an additional 87,000 jobs in December, for a total of 227,000 jobs lost.

- Further, in November the U.S. added 72,000 fewer jobs than originally reported.

- That brought the three-month average of job gains to just under 29,000, which is about 100,000 less than needed simply to keep up with population growth — to say nothing of the 9.9 million people who had jobs in February 2020 but do not now.

What they're saying: "I'm afraid that the job market is stalling," Treasury secretary and former Fed chair Janet Yellen told CBS on Sunday morning.

- "We have 10 million people unemployed, 4 million have dropped out of the labor market and another 2 million are working part time who really would like full-time work."

- "We're in a deep hole with respect to the job market and a long way to dig out."

The big picture: While the low-tax environment and the Fed's supereasy monetary policies are helping make businesses flush with cash, it's not being used to hire workers.

- Additional profits are being plowed into technology advances like AI and e-commerce, stock buybacks and adding cash reserves to pad balance sheets.

To be sure: As Fed chair Jerome Powell has said repeatedly, the economy's recovery is largely dependent on beating the coronavirus pandemic.

- However, the Fed's $3 trillion reaction to the pandemic has clearly been very beneficial to asset prices since March, but the real economy and real people have seen much less benefit.

The intrigue: While Powell has said the Fed must continue its easy money policies to help low-income workers and people of color who have borne the brunt of the crisis, researchers from the New York Fed found the Fed's policies have done little to reduce the inequality they face.

- "On the contrary, it may well accentuate inequalities for extended periods," the New York Fed's Monetary Policy and Racial Inequality report concluded.

- "Over multi-year time horizons, the employment effects are substantially smaller than the countervailing portfolio effects."

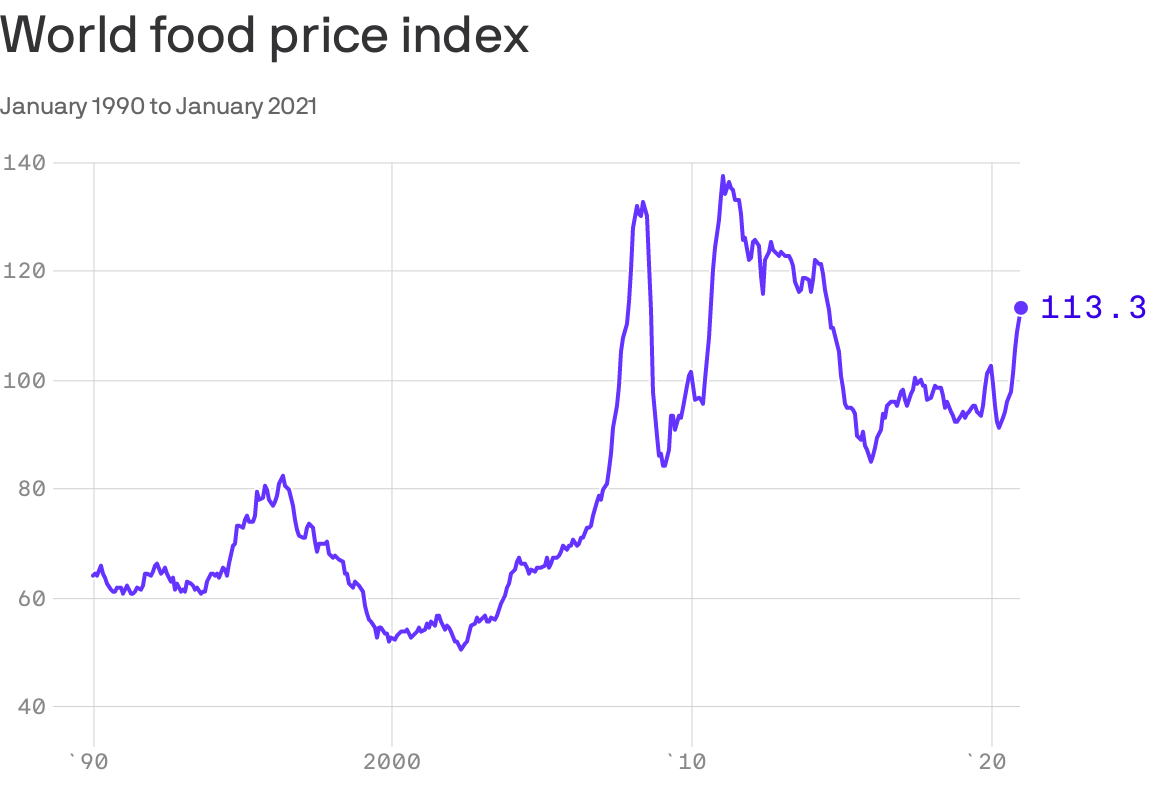

On the other side: Prices have hardly been stable. In addition to the extreme increase in health care and higher education costs and the price of food climbing at its fast rate since 2014, asset prices are inexplicably high.

- The price of the stock and housing markets are increasingly untetethered from fundamentals and commodity prices now are moving in a similar direction.

Food prices rise to highest since 2014

The U.N.'s Food and Agriculture Organization’s food price index rose to 113.3 in January, up 4.3% from December's level.

- The increase not only marked the eighth consecutive month the index has risen but the highest it has been since July 2014.