Reddit traders drive historic market activity as they seek to pummel Wall Street's old guard

Reddit traders are taking on Wall Street pros at their own game with this basic mantra: Stocks will always go up.

Why it matters: Their trades — egged on in Reddit threads — have played a role in historic market activity in recent days.

- Their influence has caused sharp swings that have so far been contained to a handful of stocks that had largely been left for dead.

The intrigue ... A stunning stat sums up Monday’s trading session: There were 32 million call options, or bets that particular stocks would rise, in one day — the second highest ever.

How it happened: The rise of Robinhood and other fee-free trading apps was paired with a pandemic that left millions stuck at home with spare time, a risk appetite, and extra cash.

- A sign of the mania: GameStop, which has emerged as the poster child for the Reddit options trading frenzy. Its stock was halted nine separate times by the New York Stock Exchange because of outsized volatility.

How it works: When a heavily shorted stock, or bets that a stock price will fall, keeps going up, the short sellers have to buy back more stock to cover their trade — pushing the price up even higher.

- Hedge fund Melvin Capital Management got slammed for being on the short-selling side of the bet for stocks like GameStop.

- It received a much-needed cash infusion from fellow hedge funds Point72 and Citadel, the Wall Street Journal reported.

Sell-side analysts are pushing back: Telsey Advisory Group slashed its rating on GameStop, while another defended the decision to cease covering the company altogether.

The overwhelming consensus: Retail traders are beating out the old guard for now (see: GameStop short sellers have mark-to-market losses of a whopping $6 billion so far this year), but it ends badly for the the Redditors.

- GameStop “represents nothing more than the gamification of Wall St by tech firms that make 'trading' so available., its shameful....but they all need to get burnt so that they learn what they don't know,” long-time equity broker Kenny Polcari tweeted.

What they’re saying: “We see the increased interest by retail investors (particularly younger investors) as encouraging, as surveys show that this group has been reluctant to invest,” Mark Hackett, Nationwide’s chief of investment research, tells Axios.

- “But the risk-seeking behavior seen in certain pockets recently is not healthy.”

The bottom line: The pandemic era’s Reddit traders are squeezing Wall Street’s most sophisticated investors.

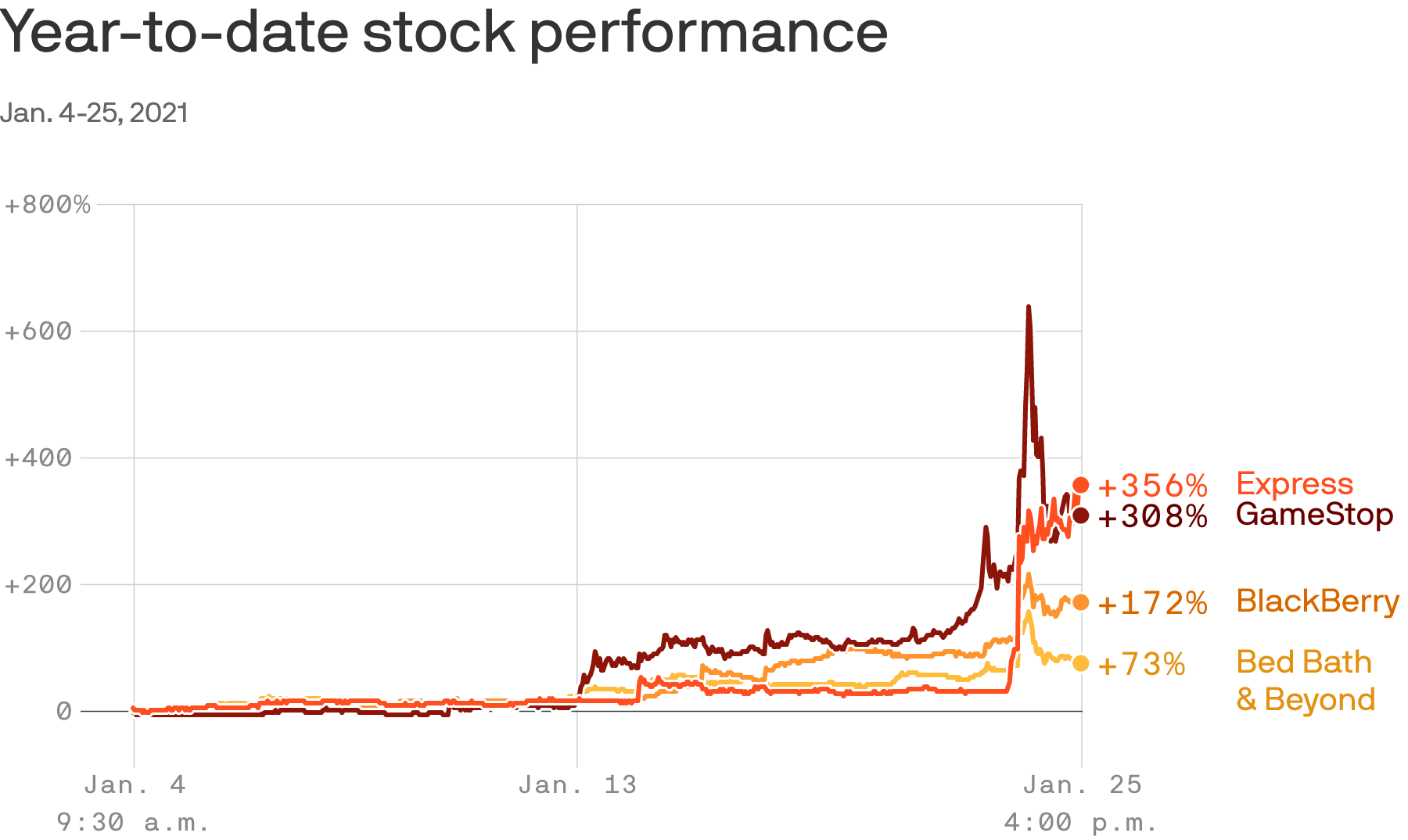

Bonus chart: The nostalgia trade

Some of the best-performing stocks of 2021 are brands familiar to anyone who used to hang out in malls as a kid in the mid-2000s, notes Axios' Felix Salmon.

Why it matters: The iPhone killed Blackberry and the pandemic hit suburban retail chains. But memories linger, and this is a market where day traders love nothing more than to pile into beaten-down stocks with a lot of short interest — especially if they carry instantly recognizable brand names.