The divide between Tesla's sky-high value and reality mirrors the economy

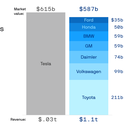

Tesla is now more valuable than the combination of the world’s top seven traditional auto makers, despite only delivering half a million cars this year.

Why it matters: Anyone searching for evidence that the stock market and the real economy are not the same thing, should look no further.

- Tesla’s frenzied ride in the capital markets culminated on Monday in the company being the largest entrant ever be included in the S&P 500, the main benchmark stock index.

Tesla’s true believers are not paying for actual performance, but they are betting on Elon Musk as a visionary and the potential upside in the still nascent electric vehicle market.

- The merits of that investment thesis diverge greatly from the current state of affairs in the automotive industry, and the broader economy.

Reality check: The overall equity market’s meteoric rise in the face of a U.S. economy that will end 2020 3% smaller than it started the year, is just the latest example of the economic reality decoupling from stocks.

- The equity market backdrop is a simple case of buyers needing to “invest in the market you have, and not the one that you want,” says Quincy Krosby, chief market strategist for Prudential Financial.

- “It is a market that has been engineered by the liquidity of central banks. ... It is surprising how far we've come, and that includes Tesla," Krosby says.

Driving the news: While Tesla mania was once limited just to those who back Musk, after today anyone invested in an S&P index fund is essentially being forced along for the ride.

- After months of anticipation and active buying, technical pressure pushed the stock down about 6% after its S&P 500 debut.

- That's happening alongside a broader market decline tied to a new wave of coronavirus concerns in the UK.

What they’re saying: “Tesla shares are in our view and by virtually every conventional metric not only overvalued, but dramatically so,” wrote Ryan Brinkman, a JPMorgan analyst, in a research note.

- In the past two years, Tesla’s shares have risen more than 800% as analysts have increased average 12-month price targets more than fourfold and simultaneously lowered earnings per share estimates annually through 2024, Brinkman notes.

Yes, but: Tesla makes cars, but they could also be categorized alongside pure tech or electric vehicle companies. It is early in the "golden age of EV playing out globally," says Dan Ives, an analyst at Wedbush Securities.

- Ives estimates that EV sales will grow from 3% of overall auto sales to 10% by 2025. "Many of the naysayers are probably the same individuals that thought LeBron wasn't going to be a good basketball player 15 years ago.”