EIA forecasts U.S. oil boom will reverse amid coronavirus disruption

Published Date: 4/8/2020

Source: axios.com

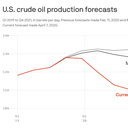

Pain in the U.S. oil patch from the coronavirus outbreak is no longer on the horizon. It's here, and several new reports and data points show how quickly it's happening.Driving the news: The Energy Information Administration yesterday released a sharp downward revision to its U.S. crude oil production forecast.Declines are now projected to be deeper and begin faster than the prior forecast issued less than a month ago, as the chart above shows.EIA now sees U.S. crude oil production falling to an average of 11.76 million barrels per day this year and just over 11 million in 2021.And via Politico, "EIA's forecast may still be too rosy, since many industry analysts are expecting U.S. production to decline by 3 million barrels per day or more this year as companies tighten spending and idle drilling rigs."The big picture: EIA's closely watched outlook was not the only sign yesterday of how the twin effects of collapsing demand and low prices are taking hold, prompting layoffs and pushing some firms closer to bankruptcy.Reuters reports on fresh layoffs this week at a number of oilfield service companies, and the Houston Chronicle writes that fracking giant Halliburton laid off another 350 workers Monday.What they're saying: A new report from the Kansas City Fed, which surveyed energy companies, finds that activity "decreased at a steep pace in the first quarter of 2020."Why it matters: The Kansas City Fed region covers oil and natural gas producing states of Colorado, Wyoming, and Oklahoma.What they found: The survey showed that expectations around future profits, employment, spending and revenues all fell.What's next: The survey asked what prices for WTI the firms need for drilling to be profitable in fields where they're active. The average is $47-per-barrel. Prices are currently in the $24 range.Threat level: Participants in the survey expect, on average, that 61% of firms will stay solvent in the next year if prices were at $30, and that only moves to 64% at $40.Meanwhile, the law firm Haynes and Boone, which carefully tracks industry finances, yesterday issued its latest report on bankruptcies and what's ahead.They tallied eight bankruptcies in the oilfield services sector in Q1, a slight uptick over Q4 of 2019 but below Q3 2019 levels.Seven oil-and-gas companies filed for bankruptcy, which is below the prior three quarters.However, their analysis finds that as Q2 begins, "extreme financial pressure is being felt at all levels of the energy industry."Among oilfield services companies, "many smaller or highly leveraged companies may not be able to hold on."Here are a few more top-line findings from the latest EIA report, which show the effects of the U.S. lockdowns and vastly reduced economic activity stemming from the pandemic.These are all annualized effects, so bear in mind that the near-term impacts are more significant.By the numbers: EIA sees a 9% annual decline in gasoline consumption this year compared to 2019 (and the current decline is far steeper).Retail electricity sales to the commercial sector are expected to decline by 4.7% year-over-year due to business closures, while factory cutbacks mean sales to the industrial sector fall by 4.2%.Total annual electric power generation is projected to decline by 3%, while generation from coal, which has already been losing market share for years, falls by 20%.Energy-related carbon dioxide emissions (which are the lion's share) are projected to fall by 7.5% in 2020, but then rise 3.6% next year.They expect the U.S. to revert back to being a net importer of crude oil and petroleum products combined in Q3 and remain that way for a while.But, but, but: There are all kinds of known unknowns, which EIA acknowledges in the latest 2020–2021 outlook.The monthly report is "subject to heightened levels of uncertainty" because COVID-19's effect on energy markets is "still evolving."