Recession fears return to the market

Published Date: 1/28/2020

Source: axios.com

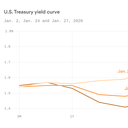

Data: U.S. Treasury; Chart: Naema Ahmed/AxiosGrowing worry over the widespread outbreak of the Wuhan coronavirus is compounding an already jittery market and flipping the switch from risk-on to risk-off, as investors sell stocks and buy bonds.Driving the news: The S&P 500 posted its biggest single day percentage loss since October and long-dated U.S. Treasury yields fell, putting yields on Treasury bills that mature in three months just 6 basis points below Treasury notes maturing in 10 years.Why it matters: The yield curve already has inverted out to seven years and is within spitting distance of the 3-month/10-year inversion that economists at the Fed call the "best summary measure" of economic downturn for the second time in less than a year.The spread between the yields on the 3-month bill and 10-year note is the smallest since October when the curve first returned to positive territory after about four months of inversion.What's happening: The death toll from the coronavirus reached 107 in China and the number of confirmed diagnoses rose to over 4,000, with confirmed infections in almost 20 countries or regions.The virus is spreading and concern is growing right as stock euphoria looks to have peaked and a swath of risks have again reared their heads.Details: President Trump's impeachment trial took an unexpected turn when the New York Times reported former national security adviser John Bolton's claim that Trump told him aid to Ukraine was dependent on the country investigating former Vice President Joe Biden and his son, Hunter.Middle East tensions have again risen as rockets reportedly hit the U.S. Embassy in Baghdad on Sunday.A growing number of market analysts and major investment banks have issued warnings about the increasingly bloated prices of U.S. equities.What we're hearing: "We're ... getting pretty nervous that we'll see another inversion," Ian Lyngen, head U.S. rates strategist at BMO Capital Markets, tells Axios. "'Recessionary fear' headlines will surely make the rounds again.""If you were on the negative side, the interpretive view of the inversion would be that a recession is closer than not," Ellis Phifer, market strategist at Raymond James, adds."The last few days are all about safe haven buying of Treasuries just in case the Wuhan virus becomes a worst case scenario," Lou Brien, rates strategist at DRW Trading, says in an email. "It is not likely this situation is resolved quickly, so the inversion likely has further to go."Go deeper: Biden: "We're likely to inherit a recession" from TrumpNovember jobs report could set the tone for the economy in 2020Health care hiring is recession-proof