Climate change has become a lightning rod for businesses

Published Date: 1/24/2020

Source: axios.com

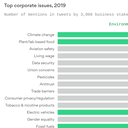

Reproduced from High Lantern Group; Chart: Axios VisualsClimate change has, quite suddenly, become a lightning rod for business and finance leaders around the world.Driving the news: Climate generated the highest degree of public pressure on corporations by activists, policymakers and journalists last year, according to data analyzed by consultancy High Lantern Group and provided exclusively to Axios. The topic's mention rose 77% over 2018.How it works: This is the survey's second year and includes analysis of more than six million tweets. Of course, Twitter is not the only barometer of influence, but Rob Gluck, the group's managing partner, says, "The vast majority of relevant public actors are using that platform to communicate." The big picture: The survey comes amid an intensifying backdrop. In recent months, the world's foremost economic institutions have advocated for policies cutting greenhouse gas emissions. This trend is driven by a confluence of factors, including more extreme weather and greater public pressure. The institutions include the International Monetary Fund, Bank for International Settlements, Organization for Economic Co-operation and Development and major central banks. And the official agenda at the World Economic forum this week is dedicated entirely to climate change.What they're saying: The BIS — known as the central bank for central banks — warned Monday in a research paper that climate change could cause "potentially extremely financially disruptive events that could be behind the next systemic financial crisis.""This complex collective action problem requires coordinating actions among many players including governments, the private sector, civil society and the international community."IMF head Kristalina Georgieva said in a speech last week that the Fund "ought to begin to build standards for disclosure of climate risks," including "mandatory disclosure standards."The intrigue: Finance and economics-focused groups have increasingly been pushing governments to implement carbon taxes, an approach championed last year by every living former chair of the Federal Reserve and dozens of former chairmen of the Council of Economic Advisers and Nobel Laureate economists.BlackRock, the world's largest asset manager, says it's making climate change a pillar of its investment strategy, and even Goldman Sachs and JPMorgan Chase are calling for a price on carbon emissions.But, but, but: All this rhetoric should be scrutinized carefully and often. Talking about supporting policies addressing climate change is quite different from actually doing something about it. Rhetoric often outpaces action on this topic, partly because it’s a slow-moving issue: Goals are made 10-30 years out.For example, although JPMorgan CEO Jamie Dimon said Wednesday he would advocate for such a policy, his company is not a member of groups supporting it, including the Washington-based Climate Leadership Council and its lobbying arm Americans for Carbon Dividends.A JPMorgan spokesman declined to comment further. What we're watching: What kinds of substantive action we will see — if we see any at all — in the coming months following these pronouncements made at Davos and elsewhere.