Stock buybacks shattered records in 2018

Published Date: 3/26/2019

Source: axios.com

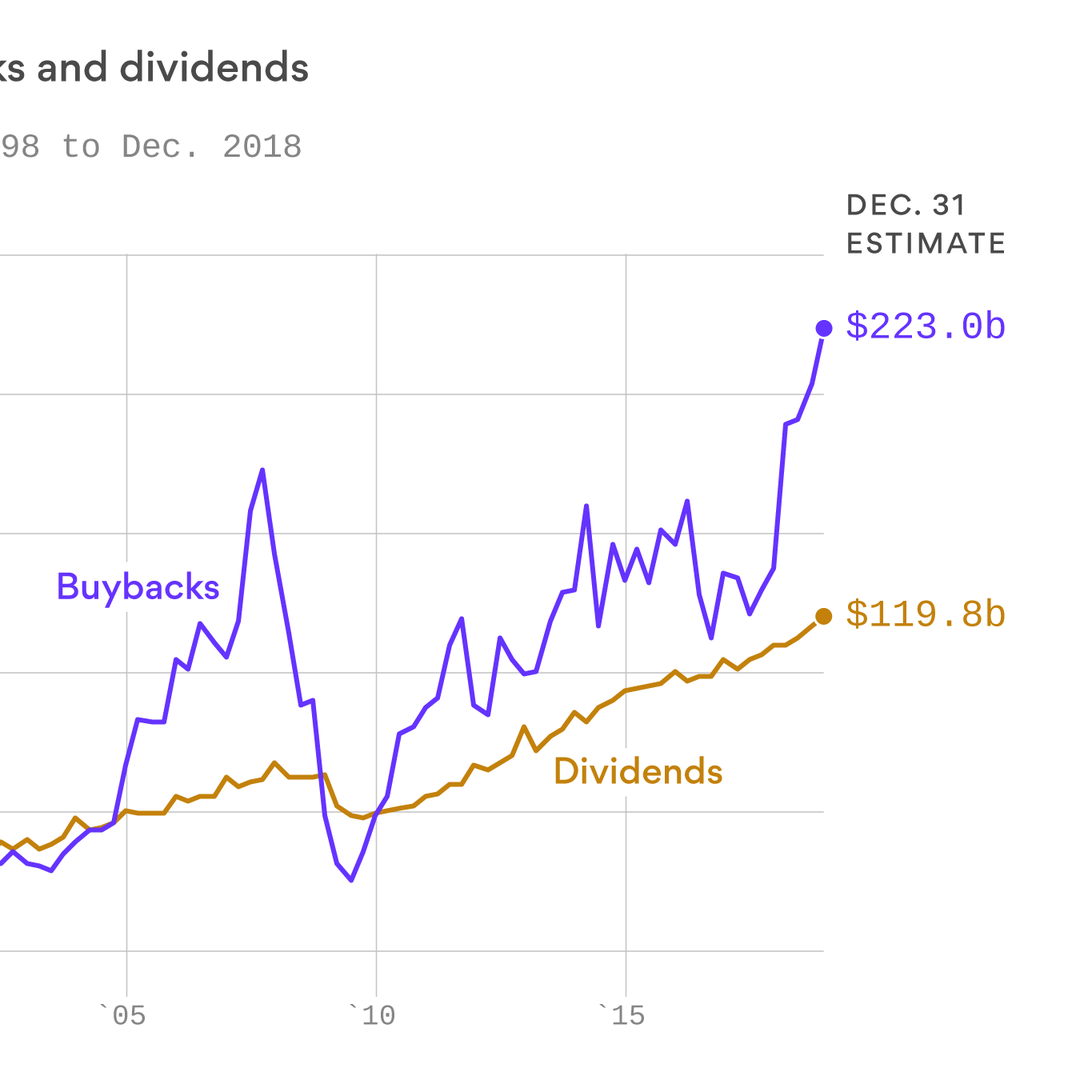

Data: S&P Dow Jones Indices; Chart: Naema Ahmed/AxiosOver the past few years the fire beneath Apple's red-hot stock price has largely been stock buybacks. The company has dwarfed other companies in terms of the number and amount of buybacks last year and for the past decade.Driving the news: S&P Dow Jones Indices announced Monday that companies bought back $806.4 billion worth of their own shares, including $223 billion in just the fourth quarter in 2018. It was short of the $1 trillion Goldman Sachs predicted in August, but still an all-time record.Of that record total, Apple bought back $10.1 billion worth of its own stock in Q4 and $74.2 billion for the year, more than a third of the entire S&P 500 total. The closest company to that total was Oracle, which spent $29.3 billion.Over the past decade, Apple has bought back more than $260.4 billion of its own shares. The No. 2 company on the buybacks list is Microsoft, which has bought back less than half that amount, $118.5 billion.Between the lines: Companies have shown a very clear preference for buybacks over dividends so far this decade, with a major uptick in this trend in 2018 after the passage of the Tax Cut and Jobs Act.Dividend spending was $27 billion below buybacks in the fourth quarter of 2017. In Q4 2018, companies spent $103 billion more on buybacks than dividends.Further buyback numbers announced by S&P Dow Jones on Monday:Q4 is the fourth consecutive quarterly record for stock buybacks, which is the longest streak in the 20 years SPDJI has been tracking buybacks.The record $806.4 billion spent on buybacks in 2018 shatters the previous record of $589.1 billion set in 2007.